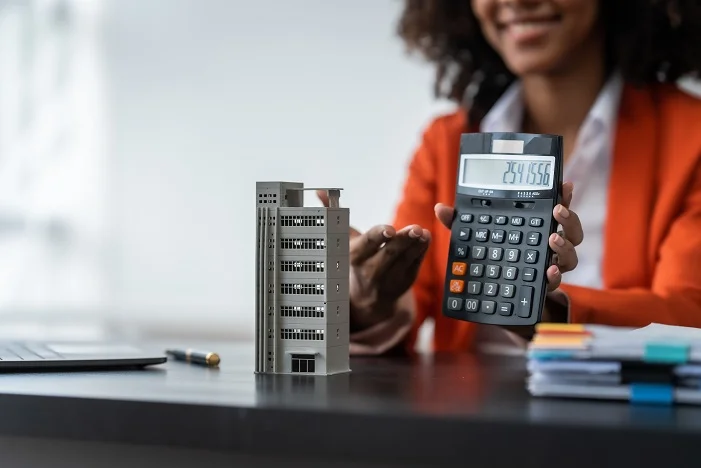

The Ultimate Guide to Financial Calculators

Understanding your income, expenses, and future savings has become more important than ever today. A recent financial survey report shows that approximately 62% of people rely on some form of online calculator for their financial planning, as spending and investment decisions become increasingly complex as incomes rise. In such an environment, accurate information helps you make better decisions. That’s why various financial calculators today act as a small financial advisor in your pocket. This guide will give you an understanding of all the important calculators you can use for everything from everyday life to major financial decisions.

Mortgage Calculator

Everyone dreams of buying a home, and this dream can only be realized if you understand your financial situation properly. A mortgage calculator helps you determine your monthly installments. Your loan amount, interest rate, and loan term play a major role in this. This calculator helps you determine in advance what size home will fit your budget. This prevents unexpected burdens in the future and helps your dream move toward reality without stress.

Loan Calculator

Personal needs can arise at any time, and sometimes a loan is necessary. A loan calculator tells you upfront how much your monthly installment will be on a fixed amount. This helps you better balance your income and expenses. When this calculator shows your EMI, you have the opportunity to consider whether taking a loan is right for you.

Auto Loan Calculator

Buying a car is a joyous moment for many, but it also involves financial calculations. The Auto Loan Calculator calculates your EMI by taking into account the car price, down payment, and interest rate. This gives you a clear picture upfront. You can determine whether a new car comfortably fits within your monthly income. This clarity helps you make better decisions.

Interest Calculator

Saving isn’t easy, but an interest calculator can instantly tell you how much your savings will grow. It tells you how much interest you’ll earn on your investment or deposit over a period of time. When the amount, interest rate, and tenure are displayed simultaneously, you can choose a more sensible path. This calculator transforms every small and big savings into a plan.

Payment Calculator

A payment calculator is useful when you have a variety of payment options. Understanding the different installments can sometimes be difficult. This calculator makes your payment amount simple and clear. You can choose the installment period that suits you best so you don’t overburden your pocket.

Retirement Calculator

Retirement may seem far away, but preparing for it should begin early. The retirement calculator combines your age, savings, expenses, retirement goals, and future needs to tell you how much you should save each month. This calculator plays a vital role in strengthening your financial security for the years to come.

Amortization Calculator

The Amortization Calculator is extremely useful for those with long-term loans. This calculator breaks down the EMI and shows how much goes toward interest and how much toward principal each month. This clear understanding helps you see how your loan is progressing. Many people also use this calculator to understand strategies like the velocity banking calculators.

Inflation Calculator

Inflation directly impacts your savings. The Inflation Calculator shows you how much a current amount could be worth in the future. When you save for a goal, this calculator helps you understand the real value. This helps you determine the right size of your investment and prepare for future needs.

Finance Calculator

The Finance Calculator is an all-in-one tool. It can calculate interest, investments, EMIs, budgets, and more. Using this calculator, you can better manage your entire financial activity. It is useful for anyone who wants to balance their income, expenses, and investments.

Income Tax Calculator

Tax calculations are confusing for many people. The Income Tax Calculator takes into account your income, deductions, and other factors to tell you how much tax you will have to pay. This helps you plan in advance and reduces last-minute panic. This calculator helps you in achieving sound tax planning.

Compound Interest Calculator

Compound interest plays a significant role in increasing your wealth. The Compound Interest Calculator shows you how your deposits can grow exponentially year after year. When interest also starts earning interest, the results are astonishing. This calculator is especially useful for those looking to invest for the long term.

Salary Calculator

Salary Calculator shows you how to calculate your salary in several ways. It breaks down the amount into parts to show the actual amount you’ll receive. It takes into account taxes, deductions, and other factors. When you’re considering a job change or a new offer, this calculator helps you compare different offers.

Interest Rate Calculator

The Interest Rate Calculator is useful when you need to find out the interest rate applicable to a loan or investment. Sometimes, even when the amount and term are fixed, it can be not easy to understand the interest rate. This calculator simplifies the calculation and helps you make more informed decisions.

Investment Calculator

Investments secure your future, but it’s important to know how much you’ll earn from investing. The investment calculator accurately calculates returns based on your principal, expected return rate, and time horizon. This makes it easier to compare long-term investments like SIPs, mutual funds, or other options.

Sales Tax Calculator

The Sales Tax Calculator is useful for those who want to know the actual price of a product or service. It tells you what the final price will be after taxes are added. This helps you make more informed purchases and keep your budget on track.

Alex Morgan is a home improvement enthusiast from the U.S. who loves simplifying complex calculations for builders and DIYers. At TogCalculator.com, Alex shares easy-to-use guides and accurate calculator tools that help homeowners plan smarter projects. His goal is to make construction math simple, reliable, and stress-free for everyone.